Money touches nearly every aspect of our lives—where we live, what we do, and how we prepare for the future. Yet, most of us were never taught how to manage it effectively. The good news? You don’t need a finance degree or a Wall Street background to get your money right. Everything you need to know is can be found by reading our personal finance reading list.

Books are a gateway to financial freedom. They allow us to learn from others’ successes, avoid their mistakes, and gain insights into how money really works—not just in numbers but in emotions, behavior, and mindset.

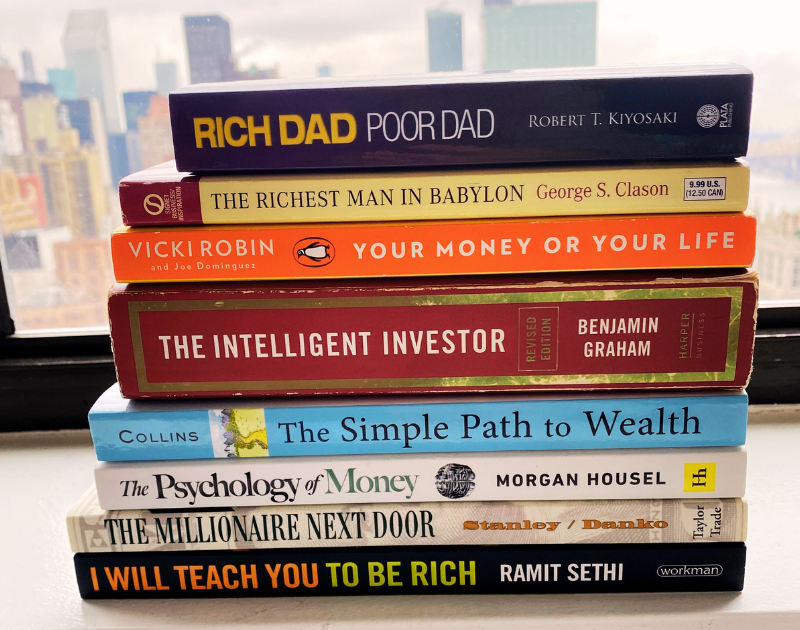

But here’s the thing: not all personal finance books are created equal. Some focus on technical strategies, like investing or budgeting, while others dive deep into the psychology of money or the broader philosophy of wealth-building. Our personal finance reading list was carefully curated to include the best of both worlds—practical advice you can act on today and timeless principles that will serve you for life.

Let’s dive in. Your journey to mastering money starts here.

What Makes a Great Personal Finance Book?

Some personal finance books promise to make you rich overnight with flashy gimmicks, while others bog you down with technical jargon that feels more like a math textbook than a helpful guide. The best personal finance books strike a perfect balance—they’re insightful, relatable, and actionable.

Here’s what separates a truly great personal finance book from the rest:

1. Practical Advice You Can Actually Use

A great personal finance book doesn’t just tell you what to do—it shows you how to do it. Whether it’s creating a budget, investing in your first index fund, or negotiating a higher salary, the best books leave you with clear steps you can take immediately.

2. Timeless Principles Over Trendy Fads

While flashy trends come and go, the fundamentals of money management rarely change. The best books focus on long-term strategies that work in any economy, like saving consistently, avoiding debt, and letting compound interest do the heavy lifting.

3. Relatable and Approachable Writing

No one wants to read a book that feels like a lecture. The best authors make complex financial topics easy to understand and even enjoyable. They tell stories, use humor, and share their own mistakes to help you feel like you’re learning from a trusted friend—not an intimidating expert.

4. Unique Perspectives on Money

The best personal finance books go beyond the basics of saving and spending. They might explore the psychology of money, the cultural and historical context of wealth, or how your emotions influence financial decisions. These unique perspectives can make a book stand out and give you new ways to think about money.

5. Inspires Action and Change

A truly great personal finance book doesn’t just teach—it motivates. You should close the book feeling empowered to take control of your finances and inspired to take the first step toward your goals.

When curating this personal finance reading list, these were the exact criteria we used. Each book on this list is designed to meet you where you are and guide you toward where you want to be, no matter your financial starting point.

The Core 5: Must-Read Books for Every Stage of Personal Finance

Our must-reads aren’t just bestsellers—they’re blueprints for building wealth, managing money, and transforming your financial mindset. Whether you’re just starting out or looking to refine your strategy, these 5 personal finance books form the perfect foundation.

1. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

If you’ve ever wondered what separates millionaires from the rest, this book has the answers—and it’s not what you think. Forget flashy cars and luxury vacations; most millionaires live modestly, invest consistently, and value financial independence over status.

Key takeaway: Wealth isn’t about how much you earn—it’s about how much you keep and how you grow it over time.

2. Your Money or Your Life by Vicki Robin and Joe Dominguez

This classic helps you redefine your relationship with money. It’s not just about numbers; it’s about aligning your spending with your values and reclaiming your time. The book’s step-by-step program teaches you how to track your expenses, rethink your habits, and ultimately achieve financial independence.

Key takeaway: Every dollar you spend represents time from your life—use it wisely.

3. The Psychology of Money by Morgan Housel

Money isn’t just math—it’s emotions, behavior, and deeply ingrained habits. Morgan Housel brilliantly weaves together stories and insights to show how our beliefs about money shape our financial decisions. This book is an eye-opener for anyone who wants to understand the human side of finance.

Key takeaway: The most important financial decisions are often behavioral, not technical.

4. I Will Teach You to Be Rich by Ramit Sethi

This is the ultimate guide for anyone who wants a no-nonsense, practical approach to managing their finances. Ramit Sethi’s six-week program covers everything from optimizing your spending to automating your savings and investing—without giving up the things you love.

Key takeaway: A “rich life” is personal. Spend extravagantly on what you love and cut ruthlessly on what you don’t.

5. The Simple Path to Wealth by JL Collins

If you’re looking for a straightforward, no-frills guide to financial independence, this is it. JL Collins breaks down the power of investing in low-cost index funds and why they’re the smartest, simplest way to grow your wealth over time. Originally written as letters to his daughter, the book is as heartfelt as it is practical.

Key takeaway: Build wealth the easy way—save consistently, invest in index funds, and let compound interest do the rest.

Each of these books offers something unique, but together, they create a comprehensive roadmap for mastering money. Start with one that speaks to your current financial goals, and watch as the lessons transform how you think about and manage your finances.

Niche Picks for Specific Financial Goals

Once you’ve tackled the foundational books, it’s time to dive deeper into specific areas of personal finance. Whether you’re focused on investing, getting out of debt, or achieving early retirement, these niche picks are tailored to help you crush your unique financial goals.

6. The Little Book of Common Sense Investing by John C. Bogle (Investing Made Simple)

Written by the father of index investing, this book explains why low-cost index funds are the smartest investment option for most people. Bogle emphasizes long-term growth, diversification, and avoiding the noise of the market.

Best for: Anyone looking to simplify their investment strategy and maximize returns over time.

7. The Total Money Makeover by Dave Ramsey (Getting Out of Debt)

Dave Ramsey’s no-nonsense, step-by-step approach to paying off debt and building wealth has helped millions. His “Baby Steps” method is simple to follow and focuses on building a solid financial foundation.

Best for: Those struggling with debt or looking to regain control of their finances.

8. Early Retirement Extreme by Jacob Lund Fisker (Financial Independence and Early Retirement)

For those ready to challenge conventional norms, this book provides a rigorous, minimalist approach to achieving financial independence. Jacob Lund Fisker takes a systems-thinking perspective that encourages reducing expenses to the bare minimum.

Best for: Ambitious readers committed to achieving FI through extreme frugality and efficiency.

9. The Intelligent Investor by Benjamin Graham (Advanced Investing Strategies)

This timeless classic dives deep into the principles of value investing and provides a framework for analyzing stocks. While it’s more technical than most, it’s an invaluable resource for those who want to think like Warren Buffett.

Best for: Readers ready to level up their investing knowledge with a focus on long-term success.

10. The Richest Man in Babylon by George S. Clason (Financial Principles and Wealth Building)

This classic book offers timeless parables filled with practical money lessons. Through engaging stories set in ancient Babylon, Clason teaches essential financial principles like saving, budgeting, and the power of compound interest.

Best for: Those seeking foundational wisdom on wealth building and financial discipline.

11. Rich Dad Poor Dad by Robert Kiyosaki (Building Wealth and Changing Mindsets)

This wildly popular book challenges traditional ideas about work, saving, and investing. Kiyosaki’s storytelling illustrates how to think differently about assets, liabilities, and financial independence.

Best for: Beginners who want a motivational introduction to wealth-building principles.

These niche picks go beyond the basics and cater to specific financial goals, giving you the tools to excel in areas that matter most to you.

The Underrated Gems: Hidden Treasures on Money Mastery

While many personal finance books are household names, there’s a treasure trove of underrated gems that deserve your attention. These books may not always top bestseller lists, but they offer profound insights and unique perspectives on money, wealth, and life.

12. Die With Zero by Bill Perkins

This thought-provoking book challenges traditional financial planning by encouraging readers to optimize their money for maximum life enjoyment. Perkins argues for balancing saving and spending to ensure you fully experience life’s most meaningful moments.

Why it’s a hidden gem: It redefines the purpose of wealth by focusing on living, not just accumulating.

Best for: Those who want to rethink how they allocate their money across their lifetime.

13. The Wealthy Gardener by John Soforic

Blending financial lessons with personal stories, this book reads like a conversation between a wise mentor and a curious student. Soforic uses gardening as a metaphor for cultivating financial independence and meaningful living.

Why it’s a hidden gem: Its mix of storytelling and actionable advice makes it both relatable and inspiring.

Best for: Readers who enjoy wisdom presented in a parable-like format.

14. The Coffeehouse Investor by Bill Schultheis

This simple, approachable book advocates for a stress-free investment strategy centered on low-cost index funds, diversification, and long-term thinking. Schultheis emphasizes that anyone can build wealth without complicated financial strategies.

Why it’s a hidden gem: It strips investing down to its essentials, making it perfect for beginners and seasoned investors alike.

Best for: Those who want a straightforward, no-frills approach to investing.

15. Set for Life by Scott Trench

Scott Trench offers a practical guide to achieving financial independence by focusing on maximizing income, minimizing expenses, and investing wisely. His clear, step-by-step approach makes wealth-building accessible to everyone, no matter where they are starting from.

Why it’s a hidden gem: Trench’s actionable advice is grounded in real-world success and focuses on building sustainable wealth.

Best for: Readers committed to long-term financial freedom through deliberate financial planning.

How to Make the Most of This Personal Finance Reading List

Reading about personal finance is a powerful first step, but it’s what you do with the knowledge that truly transforms your life. To get the most out of this curated reading list, it’s essential to approach it with a strategy that turns ideas into action. Here’s how:

1. Start with Your Goals

Ask yourself: What am I hoping to achieve? Are you trying to get out of debt, start investing, or plan for early retirement? By identifying your primary financial goal, you can prioritize books that align with your current needs.

For example:

- Struggling with debt? Start with The Total Money Makeover.

- Looking to build wealth? Dive into The Simple Path to Wealth.

- Interested in behavior and mindset? Pick up The Psychology of Money.

2. Take Notes and Highlight Key Lessons

Don’t just read—engage. Jot down the ideas that resonate most and highlight actionable steps. If a book recommends a specific budgeting strategy, try implementing it immediately. If an investment concept feels new, research it further to deepen your understanding.

3. Apply What You Learn

Books are only valuable if their lessons translate into action. After finishing each book, pick one or two key takeaways to implement right away. Whether it’s automating your savings, choosing an index fund, or redefining your spending habits, putting knowledge into practice is the real game-changer.

4. Build a Support System

Consider sharing what you’re reading with a friend, partner, or online community. Discussing ideas and sharing your progress can keep you motivated and help you stay accountable.

5. Revisit and Reflect

Some lessons will resonate more deeply as your financial journey evolves. Don’t hesitate to revisit these books over time. A concept that seemed abstract today might become crystal clear when you’re tackling a new financial milestone.

6. Embrace the Long Game

Financial mastery isn’t achieved overnight, and neither is absorbing the wealth of knowledge these books provide. Take your time, focus on progress rather than perfection, and celebrate small wins along the way.

Bonus: Frequently Asked Questions About Personal Finance Books

When it comes to this personal finance reading list, it’s natural to have questions. Here are some of the most common ones, along with practical answers to help you get the most out of your reading journey.

1. How Do I Choose the Right Personal Finance Book for Me?

Start by identifying your current financial goals or challenges. Are you paying off debt? Focus on books like The Total Money Makeover. Want to learn about investing? Try The Little Book of Common Sense Investing or The Simple Path to Wealth. If you’re looking for a broad overview, Your Money or Your Life is a great place to begin.

2. Do I Need to Read Every Book on This List?

Not at all! This list is meant to provide options for various stages of your financial journey. Begin with one or two books that resonate with your current goals and expand your reading as your needs evolve.

3. Are Personal Finance Books Only for People With Money Problems?

Absolutely not. While some books focus on overcoming debt or financial hardship, many are about building wealth, creating financial independence, or refining your approach to money. No matter where you are financially, there’s always something to learn.

4. Can I Still Benefit from These Books if I’m Not a Numbers Person?

Yes! Many of the books on this list are written in a conversational and approachable tone, designed for people of all financial literacy levels. Books like I Will Teach You to Be Rich and The Psychology of Money focus on mindset and habits, making them perfect for those who don’t love crunching numbers.

5. Are Audiobooks a Good Way to Consume Personal Finance Books?

Definitely! Audiobooks are a fantastic option if you’re short on time or prefer listening over reading. They’re especially useful for books that are more story-driven, like The Millionaire Next Door. Just make sure to take notes or jot down actionable ideas as you listen.

6. How Long Will It Take to See Results After Reading These Books?

Results depend on how quickly and consistently you apply what you learn. If you start implementing strategies—like automating savings or creating a budget—immediately, you may see changes within weeks. Larger goals, like financial independence, require time and patience but are achievable with consistent effort.

7. Are Personal Finance Books Still Relevant in Today’s Economy?

Yes! While specific examples or figures might change over time, the principles of budgeting, investing, and wealth-building are timeless. Many books also update editions to reflect current market trends and economic realities.

Complete Personal Finance Reading List

1. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

2. Your Money or Your Life by Vicki Robin and Joe Dominguez

3. The Psychology of Money by Morgan Housel

4. I Will Teach You to Be Rich by Ramit Sethi

5. The Simple Path to Wealth by JL Collins

6. The Little Book of Common Sense Investing by John C. Bogle

7. The Total Money Makeover by Dave Ramsey

8. Early Retirement Extreme by Jacob Lund Fisker

9. The Intelligent Investor by Benjamin Graham

10. The Richest Man in Babylon by George S. Clason

11. Rich Dad Poor Dad by Robert Kiyosaki

12. Die With Zero by Bill Perkins

13. The Wealthy Gardener by John Soforic

14. The Coffeehouse Investor by Bill Schultheis

15. Set for Life by Scott Trench

Want to see other incredible books we recommend? Check out this amazing list!

Conclusion: Start Your Personal Finance Journey Today

Mastering personal finance isn’t just about building wealth—it’s about creating the freedom to live life on your terms. Whether you’re just starting to pay off debt, aiming to grow your investments, or dreaming of early retirement, the right knowledge is your most powerful tool.

This personal finance reading list is more than just a collection of books—it’s a blueprint for transforming how you think about money, act on financial decisions, and ultimately achieve your goals.

Reading alone won’t change your life. What will? Taking action. Choose one book, commit to learning from it, and start applying its lessons immediately.

So why wait? Pick your first book from the list, dive in, and take the first step toward taking control of your financial destiny. Your future self will thank you.