If you’ve ever dreamed of beating Wall Street at its own game without being glued to a Bloomberg terminal 24/7, this One Up on Wall Street summary is your blueprint. Written by legendary investor Peter Lynch, this book reveals how everyday investors can outperform hedge funds by using common sense, firsthand observations, and a little bit of patience.

In this One Up on Wall Street summary, we’ll break down Lynch’s investing philosophy, key takeaways, and exactly how you can apply his methods to your portfolio today.

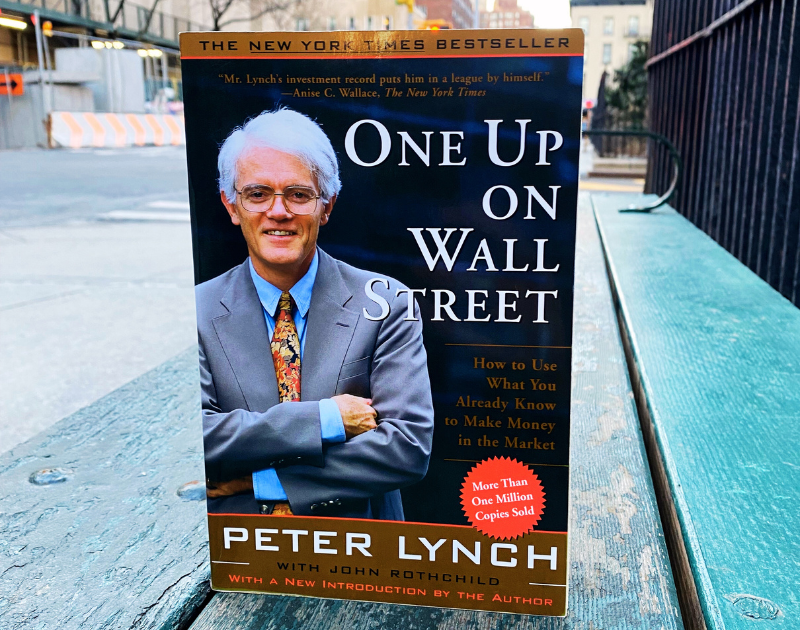

Who is Peter Lynch, and Why Should You Listen to Him?

Peter Lynch isn’t just another finance guru peddling theories—he actually walked the walk. As the former manager of Fidelity’s Magellan Fund, Lynch delivered a mind-blowing 29.2% annual return between 1977 and 1990, crushing the S&P 500.

A $1,000 investment in Peter Lynch’s fund in 1977 would have grown to approximately $27,952 by 1990 based on those staggering returns.

His secret? Finding “10-bagger” stocks — investments that grow 10x in value — and holding them for the long haul. And the best part? You don’t need a PhD in finance to do it.

One Up on Wall Street Summary

1. You Have an Advantage Over Wall Street

No One Up on Wall Street summary is complete without Peter Lynch’s most powerful point. Most people assume hedge funds and professional investors have the upper hand. Lynch argues the opposite. Why? Because you’re on the ground. You shop at stores, use products, and notice trends before analysts even write a report about them.

🚀 Actionable Tip: Pay attention to brands and businesses you love. If a company is growing fast and you see its products flying off the shelves, it might be worth researching as an investment.

2. Invest in What You Understand

Lynch’s golden rule: If you can’t explain what a company does in one sentence, don’t invest in it.

💡 Example: If you understand how Starbucks makes money (by selling overpriced coffee to caffeine addicts), you can evaluate whether it’s a solid investment. But if you have no clue how biotech companies generate revenue, you’re better off avoiding them.

🚀 Actionable Tip: Stick to businesses in industries you know and use daily.

3. The Six Types of Stocks (Know What You’re Buying)

Lynch categorizes stocks into six groups. Knowing which bucket a stock falls into helps you set realistic expectations.

- Slow Growers – Mature companies growing at 2-5% per year. (Think: Utility companies.)

- Stalwarts – Solid, dependable businesses growing at 8-12%. (Think: Coca-Cola, McDonald’s.)

- Fast Growers – Smaller companies with 20-50% annual growth potential. (Think: Netflix in its early days.)

- Cyclicals – Companies that move with the economy. (Think: Auto manufacturers, airlines.)

- Turnarounds – Struggling companies on the brink of collapse but with recovery potential. (Think: Domino’s Pizza in the early 2000s.)

- Asset Plays – Stocks that own undervalued assets others don’t see. (Think: Real estate-heavy companies.)

🚀 Actionable Tip: Match your investing style to the type of stock. If you want fast gains, fast growers should be your focus.

4. How to Identify a “10-Bagger” Stock

Lynch’s holy grail is the 10-bagger—a stock that multiplies 10x. Here’s what to look for:

1️⃣ A simple, understandable business

2️⃣ Strong earnings growth (consistent double-digit growth is key)

3️⃣ A competitive advantage (brand loyalty, patents, network effects)

4️⃣ A small or mid-sized company (big companies rarely 10x)

5️⃣ A reasonable valuation (avoid overpriced hype stocks)

💡 Example: Lynch spotted Dunkin’ Donuts early because he saw its growing popularity. The stock went on to deliver massive returns.

🚀 Actionable Tip: Look for companies quietly dominating a niche before they hit mainstream news.

5. Ignore the Market Noise and Think Long-Term

The biggest mistake investors make? Getting shaken out by short-term market swings.

Lynch advises tuning out the daily news cycle and focusing on business fundamentals. If a company is growing revenue, increasing profits, and expanding its market, short-term dips are just buying opportunities.

🚀 Actionable Tip: If you believe in a stock, hold it for years, not months.

Final Verdict: Does One Up on Wall Street Still Hold Up Today?

Absolutely. While Lynch wrote this book in 1989, his principles still apply. The rise of social media, e-commerce, and tech startups has made it even easier to spot winning stocks before Wall Street catches on.

The bottom line? You don’t need a finance degree to build wealth. You just need to pay attention, do your research, and have the patience to let great businesses grow.

Want to Read One Up on Wall Street? Grab Your Copy Here!

📚 Get One Up on Wall Street on Amazon

🔥 Ready to start investing smarter? Drop a comment below and let me know your biggest takeaway from Lynch’s strategy!

🚀 Want More Investing Wisdom? Subscribe for Updates!

If you enjoyed this One Up on Wall Street summary, be sure to subscribe to my newsletter below. For more deep dives on the best investing books, strategies, and market insights check out articles here.

Let’s build wealth — one smart investment at a time! 🚀